Personal inflation calculator: what is your inflation rate?

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

LATEST CHANGES

This page is regularly updated with the latest consumer prices data for each country

December 20: UK November data added

December 20: US November data added

October 20: Japan September data added

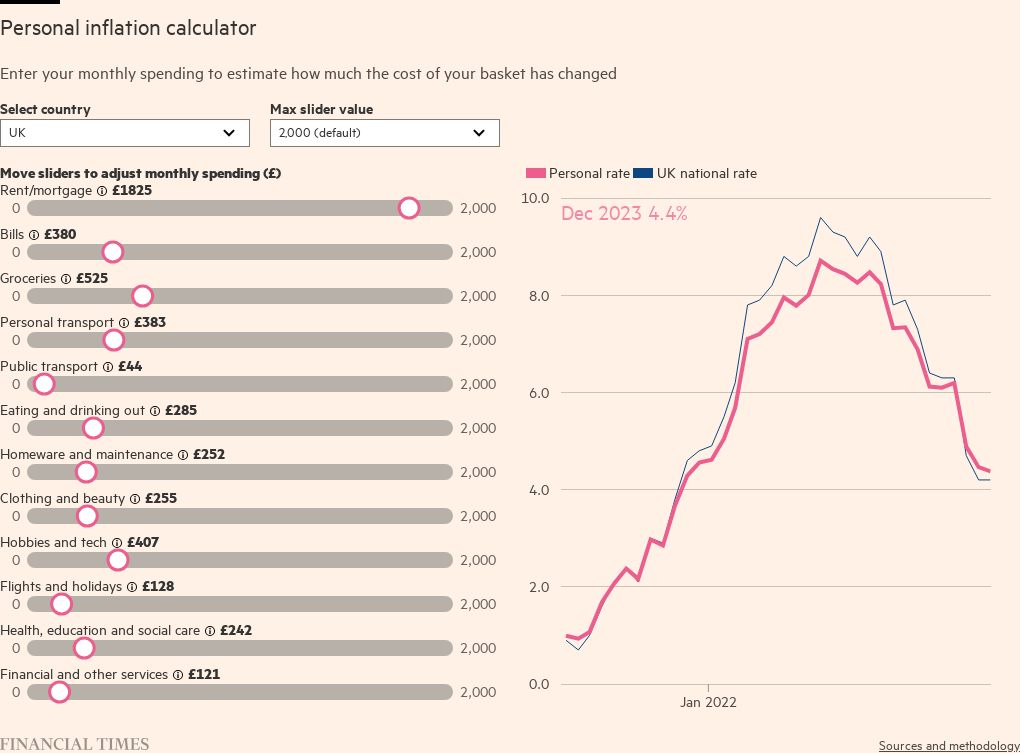

Inflation affects us all, but the rate at which we experience it will depend on our unique spending habits. Use the calculator below to estimate your personal inflation rate.

Please note:

The personal inflation calculator operates entirely within your browser and FT does not receive or store any data you enter in it. For more details of how we process personal data, please see the Financial Times Privacy Policy.

Personal inflation rates are not directly comparable across different countries.

You can input spending for either yourself individually, or for your household, but you should not input a mix of the two.

Your personal inflation trend shows the inflation rate of your personal basket in previous months. Unlike national inflation rates, this assumes there have been no changes in your personal basket over this time.

The personal inflation rates calculated with this tool are described as estimates, because the tool uses price changes that have been calculated based on national average prices. It will therefore not necessarily reflect how prices have changed for the specific goods and services that you buy. For example, the calculator will not take into account if your housing costs have increased considerably more than the national average.

Why estimate your personal inflation rate?

For the past 30 years, inflation has been relatively stable across advanced economies, including the UK and US. In others it has even been deflationary, such as in Japan.

This has been turned on its head in 2022, with the shockwaves of a global pandemic, supply-chain disruptions and the war in Ukraine all contributing to a rapid rise in the costs of fuel, food and a broad range of goods. So much so, that major national economies have reached their first double-digit inflation rates since the 1980s.

These inflation rates — most often measured by the consumer price index, or CPI — are calculated based on a total “basket” of goods and services bought by all consumers in a national economy. They do not, however, necessarily represent the impact that inflation has on you.

For example, the latest UK national basket assumes that 9.8 per cent of household budgets are spent on personal transport, such as owning and using a car. While this may be representative of the UK as a whole, it may not be at all representative for you as an individual if, for example, you don’t own a car, or the amount you use it greatly differs from the national average.

This is where a personal inflation calculator can be useful. By taking data on national price changes, it allows you to estimate your experience of inflation, according to the constraints, priorities and preferences that shape your personal spending patterns.

Sources and methodology

SOURCES

This calculator currently includes data for the UK, US and Japan using the following sources:

METHODOLOGY

Which measures of inflation does the calculator use?

There are a few variations on the CPI. We have used the following measures for each country:

UK: CPIH, which is the CPI plus imputed rental costs for homeowners

US: CPI-U (not seasonally adjusted), which measures price changes for all urban consumers (about 93 per cent of the total US population) and includes imputed rental costs for homeowners

Japan: CPI, which is the CPI plus imputed rental costs for homeowners

Should I enter irregular purchases, such as flights or appliances?

We recommend using the inflation calculator for just your regular monthly spending, since the inflation that you experience for one-off purchases will depend on when you make the purchase. This approach is best for understanding your personal inflation trend, which is the rate of inflation you have experienced for this same monthly basket in previous months. This approach is less comparable with the national inflation rate, however, as it excludes irregular purchases.

You may, however, choose to use the calculator to find out your personal rate of inflation in the following alternative ways:

Last month’s actual spending, including any irregular purchases. With this approach you can enter all of your actual spending on each category, including any irregular purchases if you paid for these last month. This approach is best for understanding the impact that inflation is currently having on your personal finances. Your personal inflation trend is the rate of inflation you would have experienced for making exactly the same purchases as you did last month in previous months.

The monthly average values of all your spending. With this approach you can include both your regular monthly spending and an average “cost per month of use” for any irregular purchases. This approach is best for comparing your personal inflation rate with the national inflation rate, but it does not necessarily reflect the inflation you will have experienced when making an irregular purchase.

How should I enter my housing costs if I am a homeowner?

For the purposes of this calculator, you can enter how much you spend on mortgage payments and home insurance in “Rent/mortgage” and how much you spend on repairs and home improvements in “Homeware and maintenance”. Taken together, these act as a proxy for owner occupiers’ housing costs.

The way in which inflation rates are measured for owner occupiers is a little complicated, since the purchase of a property is considered both an investment and a service. As a result, it is sometimes handled differently in consumer price indices.

We have chosen CPI measures for this calculator that take into account the service costs of home ownership for homeowners through a method known as “rental equivalence”. This uses the rent that an owner would have to pay for the property they live in as a proxy for the housing services it provides.

Are all items of spending included in consumer price indices?

No, spending on the following products are generally considered to be outside the scope of consumer price indices: investments; cash gifts, including donations and tips; gambling; charges for credit; interest payments on loans; and taxes not associated with consumer goods and services.

Does the inflation calculator take into account variations in prices for different items?

No, this calculator does not reflect:

Exactly what type of product you buy. For example, the inflation rates for items do not distinguish between the level of inflation on luxury or basic versions of an item.

Where in your country you buy a product. For example, the inflation of the cost of housing is based on a national average, rather than price changes in your area.

How are national inflation rates calculated?

While there is some variation between countries, typically the following steps are taken to calculate national inflation rates:

Each month, price collectors record prices for the same set of products and from a large sample of shops around the country and online.

Price changes for specific products at specific shops are aggregated into an overall price change for each type of item and indexed to represent the relative price change for that type of item over time.

Items are then weighted to ensure they reflect their relative importance in the overall shopping basket. Weights are typically based on mean household expenditure and are updated periodically (every one to two years) to reflect changes in consumer behaviour.

The overall consumer price index is calculated through a weighted average of the price changes.

How is my personal inflation rate estimated?

Your personal inflation rate is calculated in a similar way to the national inflation rate, but has been necessarily simplified as follows:

First, the calculator collects and calculates the latest and historic 12-month price indices data for each spending category from the relevant national statistics authority in the country you have selected.

The calculator then defines the weight that it should apply to each category’s price inflation based on the spending inputs you provide.

Next, the calculator mimics the calculation carried out by the national statistics authority to produce an overall personal inflation rate for every month since January 2021 up to the latest month that we have data for. In doing so, the calculator assumes that the share of your spending on each category stays the same each month.

Please note that the personal inflation rate figure we produce may include a rounding error, as we are using published figures that have been rounded by the national statistics authority.

Data and analysis by Ella Hollowood, Oliver Hawkins, Kentaro Takeda and Aiko Munakata.

Development, design and graphics by Bob Haslett and Ændra Rininsland.

Comments